When someone dies without a will in Florida, Florida’s law of intestacy controls who inherits. If there are no living relatives close enough to the Decedent, the State of Florida inherits the estate. In the case of State v Estate of Bruening, 4D2022-2421 (4th DCA 2023), the Court interpreted Florida’s intestacy statute for second cousins.

What is a Second Cousin?

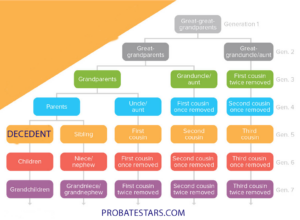

In general, cousins are related through common ancestors. First cousins have grandparents in common. Second cousins have great-grandparents in common, except that the child of a grandaunt or granduncle is a first cousin once removed. To add to the confusion, a grandchild of an aunt or uncle is also your first cousin once removed. The following chart explains the cousin relationships.

What Are Florida’s Intestacy Rules?

Section 732.103 of the Probate Code is titled, “Share of other heirs,” and provides as follows:

The part of the intestate estate not passing to the surviving spouse under s. 732.102, or the entire intestate estate if there is no surviving spouse, descends as follows:

(1) To the descendants of the decedent.

(2) If there is no descendant, to the decedent’s father and mother equally, or to the survivor of them.

(3) If there is none of the foregoing, to the decedent’s brothers and sisters and the descendants of deceased brothers and sisters.

(4) If there is none of the foregoing, the estate shall be divided, one-half of which shall go to the decedent’s paternal, and the other half to the decedent’s maternal, kindred in the following order:

(a) To the grandfather and grandmother equally, or to the survivor of them.

(b) If there is no grandfather or grandmother, to uncles and aunts and descendants of deceased uncles and aunts of the decedent.

(c) If there is either no paternal kindred or no maternal kindred, the estate shall go to the other kindred who survive, in the order stated above.

(5) If there is no kindred of either part, the whole of the property shall go to the kindred of the last deceased spouse of the decedent as if the deceased spouse had survived the decedent and then died intestate entitled to the estate.

(6) If none of the foregoing, and if any of the descendants of the decedent’s great-grandparents were Holocaust victims as defined in s. 626.9543(3)(a), including such victims in countries cooperating with the discriminatory policies of Nazi Germany, then to the descendants of the great-grandparents.

Section 732.103(4)(b) is the key section in many of these cousin cases, and in the typical case, there are no living grandparents, aunts or uncles. Instead, we have cousins. The rule is essentially that one can inherit through the deceased aunts and uncles of the Decedent. So if your ancestor was an aunt or uncle of the Decedent, you qualify under the intestacy statute. Stated differently, anyone who is descended from the Deceased’s grandparents can be an heir.

In the Bruening case, a second cousin and two second cousins once removed tried to inherit. In rejecting the claim, the court explained as follows:

Pursuant to section 732.103’s plain language, persons who have greatgrandparents in common with a decedent but who otherwise have no familial relationship with a decedent are not in a class of persons recognized as heirs of an intestate decedent’s estate. No recited category applicable here encompasses such relatives.[2] Where a decedent was never married, heirs are limited to the decedent’s descendants; parents; siblings and, if they are deceased, their descendants; grandparents; and aunts and uncles and, if they are deceased, their descendants.

In support of its position that Mills, Barter, Jr., and Luce are heirs under section 732.103, the appellee, the Estate of Kyle William Bruening (“estate”), relies on language in subsection 732.103(4)(c): “If there is either no paternal kindred or no maternal kindred, the estate shall go to the other kindred who survive, in the order stated above.” But that language, read in the context of all other provisions of section 732.103(4), provides for a scenario in which only paternal grandparents, aunts, or uncles exist, or a scenario in which only maternal grandparents, aunts, or uncles exist. In those instances, the remaining estate that would have gone to identified paternal kindred or maternal kindred does not escheat to the state. Rather, the entirety goes to the persons identified in subsection 732.103(4)(a)-(b), in the order provided. See Estate of Faskowitz, 941 So.2d 390, 392 (Fla. 2d DCA 2006) (holding that pursuant to section 732.103(4)(c), “in the absence of any maternal kindred of Irving Faskowitz, his paternal kindred . . . are entitled to inherit the whole estate”).

Put differently, one cannot inherit through a common great grandparent. A common grandparent is required.